GAP SELLING

Methodology

Sales Training That Starts With the Buyer

Sales are won by uncovering what’s broken, what it’s costing, and why it needs to be fixed now. Gap Selling gives your team the skills to find that information and use it to move deals forward.

Gap Selling SETS UP SALESPEOPLE TO BE TRUSTED ADVISERS.

Imagine walking into a doctor’s office. You say your knee hurts. Without asking a single question, the doctors hands you a knee brace and says:

“This ones our best-seller”

You’d walk out, right? That’s how 99% of sales interactions happen. You have pain? This is why my solution is the best. Reps jump to a solution without understanding any context of the buyer’s situation.

Gap Selling flips that.

Reps are taught to pause, dig in, and diagnose what the symptoms are, what it’s impacting, and why it needs to be fixed now.

Buyers don’t need another product. They need a solution to the problems putting their goals, revenue, and teams at risk.

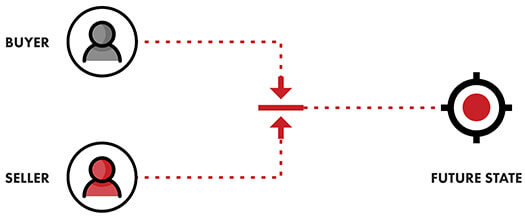

WHAT IS GAP SELLING

The Gap Selling Methodology is a sales technique that shifts the focus of the sale from your product to the buyer’s problem. In old-school selling methodologies, focusing on the features and benefits of your product meant the buyer had all the power when it came to understanding the prospect’s true needs. With Gap Selling, we teach you how to find the gap– the space between the buyer’s current and future states– and utilize that information to sell to the real problem the buyer is experiencing.

HOW IS IT DIFFERENT

FROM OTHER METHODOLOGIES?

Most sales methods teach reps to find pain and pitch the fix. They ask a few questions, get the buyer to admit something’s wrong, then start selling. Pain, however, isn’t always enough to drive change. Buyers get used to it. They adjust. They live with the limp. Gap Sellers take a different path. They dig into what the pain is actually doing to the business. Is it costing them revenue? Slowing the team down? Putting goals at risk?

That’s the stuff buyers care about. Deals move forward when buyers have a full understanding of the problem, what’s at stake, and how you solve it.

My team is struggling with…

The Root Causes

When it comes to converting opportunities, the root causes can be extensive. The primary reasons a deal doesn’t convert to a client is simply the salesperson didn’t uncover the buyer’s motivation for change. Why should that buyer by? This lack of understanding can stem from poor qualification criteria up front; it never was a qualified opportunity. The CRM or sales software isn’t being effectively used so deals slip through the cracks. The discovery process is really a feature dump where no real value is built to drive the deal forwarded. All of these root causes lead to opportunities not converting to customers.

Impacts of a Low Close Rate

When sales teams don’t convert deals, the impact in felt throughout a company. Revenue forecasting is wildly inaccurate. Cost of sales and marketing sky rocket. Fulfillment and supply chain are unclear how to plan. Stock holders and board directors become nervous. Salespeople are missing quotas. Growth goals are all on shaky ground.

Addressing Root Causes

Implementing firm and consistent qualification criteria that is customer-centric (AKA, no BANT or MEDDIC. That’s you focused) will begin cleaning up the pipeline. Implementing a sales methodology will create consistency in how deals are discussed in both deal reviews and pipeline meetings. Structuring value-based conversations around the buyer’s business problems will outline a buyer’s motivation to change, what they are changing, how, when, and the value of change.

Future State Outcomes

Can you imagine this beautiful world where your opportunity to closed won is over 50%? Sales forecasting has under 15% variance? Over 80% of your sales team makes or exceeds quota? The stock holders / owners / board are thrilled?

The Root Causes

There are two primary aspects surrounding a low average sale price. 1) Discounting. We all know it, see it, hate it. Whether it's the end of the month, quarter, year, salespeople push discounts to expedite the time to close or to compete on price. 2) Approaching sophisticated sales with transactional mindset. Here, the customer often leads the sale, the value is never defined or realized, and the solution is inevitably the cheapest plan with hopes of upgrades.

Impacts of a Low ASP

Whether its discounts or grabbing the cheap plans, these two approaches can cause major havoc in a company. Mainly: PROFIT! Those pesky discounts can yield low profit, no profit, or negative profit contracts in order to acquire that new customer. Some salespeople have ended up creating a cost of customer acquisition that ends up being 3 years of renewals before that customer begins generating profits. Ouch! The most painful part? It simply was a bandaid covering up the lack of a solid business case for the purchase at full price. All that profit loss was unnecessary.

Addressing Root Causes

Negotiating price to overcome a lack of value is a loosing scenario, even when you "win." Learn how to have business problem conversations and discoveries so the value is clear, compelling, and price isn't a factor. Truly! Would you spend $50,000 to make $5,000,000? That's what I thought.

Future State Outcomes

When price negotiations are out of the sales cycles, your average deal size will go up, the number of deals needed to make quota go down, lead generation efforts become wildly more profitable. It is an efficiency and profitability game here. Get more revenue with less time, effort, money, and headaches.

The Root Causes

Similar to when deals do not convert, a long sales cycle is often related to a messy pipeline, filled with non-customers and truly unqualified opportunities. Sales cycles can also be unnecessarily lengthen due to poor opportunity cadences/management, extended price negotiations that involve excessive back and forth, or those extra sales calls where you are working to feature compare against your competition. What do these items have in common? They are all the traps when business value is missing from the sales cycle.

Impacts of Long Sales Cycles

We hear sales leaders say they need "time management training" for their salespeople. Stop it. No you don't. You need to shorten your sales cycles which is behind the time management problem! Think about it. Let's say your average sales cycle is 6 months, average deal is $50,000 and quota per rep is 1 million. This amounts to 20 deals per year. If each opportunity involves 8 hours per week, this is 208 hours per deal. That's 80 hour work weeks per rep! Cut the sales cycle in half though, and your "time management" problem is gone. Hello 40 hour work weeks! Hello making quota! Hello happy salespeople! Hello good company culture!

Addressing Root Causes

Cleaning up a pipeline means 1) Implementing problem-centric qualification criteria, 2) holding problem-based deal reviews, 3) understanding the business problems and related business value in the purchase, 4) know when you can't help or the value is low so you can stop wasting your time on non-customers.

Future State Outcomes

Picture your sales reps working only a 40 hour work week AND making quota. Or your sales organization collectively hitting targets. They are happy. They have life balance. They stick with you. Long gone are the days 2.8 stars on glassdoor and a 1 year average tenure. Long gone are the days of tedious hiring, product training, ramp times, missed quotas, slow growth, unhappy investors...can you see it? It's a beautiful place when your reps are not spending time and effort on things that don't influence the sale or help your buyers.

The Root Causes

When it comes to building a pipeline, a lot goes into it: outbound efforts, inbound efforts, brand, messaging, market positioning...but truly, in spite of these efforts, so much of outbound and inbound efforts fail simply because they don't connect with why that buyer should even consider your product or services. How will it all help them? Instead, its all you focused: your product, your story, your fancy features, you, you, you.

Impact of Poor Pipeline

When you don't have the pipeline, the number of deals, the size of deals...when the pipeline doesn't support the goal, the impact should be obvious: you won't make your goal. You won't hit your growth target. You won't be prime for acquisition in 3 years. You won't raise that next round of funding. You won't have the cash to reinvest. You just won't.

Addressing Root Causes

Value is an agreement. It is unique to each person, company, and situation. It is not finite. It is fluid, dynamic, and contextual. Your outbound and inbound efforts, messaging, ICP, targeting, all need to align to the value you bring to your customers. The problems you solve for them. It's both simple and hard but critical to success.

Future State Outcomes

When the pipeline is clean and the numbers support the goal, you win! You hit your growth targets! You are ready for a top valuation for acquisition! You raise that now round of funding! You get the cash to reinvest! That beautiful plan you had in mind when you wrote out the revenue targets, you get to do that!

Different Ways To

Learn Gap Selling

Train Your Team

Want to build a Gap Selling organization? Check out our team training, tailored to any size sales force. Take the guesswork out of your team’s success and see if investing in sales team training would benefit your organization.

Read The Book

If you’re just starting out in your Gap Selling journey, we would recommend exploring our best selling book, Gap Selling by Keenan. You’ll get the comprehensive picture of what Gap Selling is and how to implement it in your sales techniques. It could be the best $27 you ever invest in your professional development.

Free Resource Center

Our handpicked collection of essential sales tools, eBooks, and videos. Dive into comprehensive research studies, practical strategies, and insights designed to boost your selling abilities.

Case Studies

Ryan Cannady, CRO of John Deer Employees Credit Union Increased his bank membership

Ryan was tasked with increasing the number of clients who used Deer Employee Credit Union as their primary banking institution. His team was struggling at helping members see the value of the relationship. Before Gap Selling sales training, only 18% of their 3000 members made DECU their primary financial institution. After Gap Selling, they grew that number to 40% of 7,000 members.

%

Increase in Primary Institution

%

Increase in Membership

%

Shorter Sales Cycle Length

%