Harnessing the Sales Power of Cash Flow Statements

This week we’re going to talk about cash flow statements. I find cash flow statements to be the most confusing and complicated of the three key financial statements. Therefore I’m going to do my best to keep it simple.

The Difference Between Cash Flow and PNL

In the end, cash flow statements are to designed to provide insight into the “cash” moving in and out of the business. At first glance it’s easy to think we already know this. We’ve seen the P&L statement. We know how much the company made. The problem with that is, the P&L statement only addresses what is “owed” or “earned” not necessarily the cash transaction. It’s possible for a highly profitable company to be tight on cash. An example of this is a mobile phone provider. Mobile carriers have very high capital costs to build out there networks. Capital costs don’t show up on the P&L Statements.

They are depreciated as an expense overtime. Therefore a billion dollar cash out lay won’t be seen as a billion dollar expense item on the P&L. The carrier could be showing a profit, but be cash flow negative. The other side of that coin could be service company that charges for a year of it’s services up front. The service company would get a lump sum of cash in let’s say January, but can only recognized the revenue monthly. Therefore they could be cash flow positive in the month they received the cash, but could be losing money.

How to Calculate Cash Flow

Accounting for cash flow isn’t simple. Calculating cash flow is easier so we’ll start their. To calculate cash flow, simply compare cash at the beginning of the year (or time period you want to measure) from the end of the year and you have cash flow. For example, if you begin the year with 10 million dollars in cash and ended the year with 6 million dollars in cash, you are cash flow negative by 4 million dollars. If your cash balance at the end of the year is 12 million dollars, your cash flow is positive by 2 million dollars.

As I said, accounting for cash flow gets a little more hairy but I’ll do my best to spell it out.

Pieces of Cash Flow Statements

The first thing to notice is cash can come from three key areas, operating activities, investing activities and financing activities.

Operating activities is cash spent or generated through the operations of the business, this includes cash from goods and services sold, payments to suppliers, loans sold, interest on loans etc.

Investing activities includes, cash received from or spent on the sale of assets, loans made or received, or cash spent and received from mergers and acquisitions.

Financing activities include, cash from investors such as VCs and shareholders as well as outflows of cash in the form of dividends.

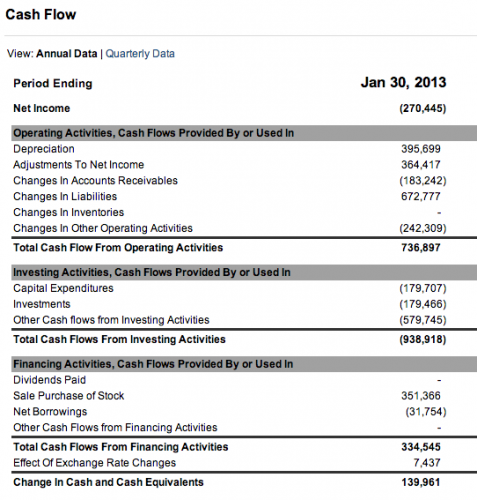

To stay consistent with the Balance Sheet and P&L posts we’ll look at Salesforce’s cash flow statement.

Operating Activities

Notice the operating category, Salesforce is generating a nice chunk of cash from operations, over 700 million dollars. That’s 30% of total revenue and operating profit.

Investing Activities

Now lets look at the investing category. Salesforce has used almost a billion dollars of cash in investing. In this category they are cash flow negative. A 179 million of the cash was in capital expenses. I’m going to assume this is primarily for hardware, servers, network infrastructure etc. Capital expenses are considered investments in the company and that’s why they show up in the investments category of the cash flow statement.

Beyond capital expenditures, Salesforce used cash in outside investments to the tune of more than 750 million. I don’t know how Salesforce is dividing “investments” from “other cash flows from investment activities” but we do know that Salesforce has been on an acquisition spree over the past few years and it could have something to do with M&A and debt.

Financing Activities

Finally, we can look at the financing activities part of the cash flow statement. Here we see Salesforce has generated over 335 million in cash from financing activities, mostly from it’s stock.

At the end of 2013, Salesforce is cash flow positive to the tune of just under 140 million dollars.

Why does cash flow matter?

If you remember in the Balance Sheet post, I say cash is king. Cash is what keeps a business going. If you run out of cash, game over, unless you can get someone to finance you. But, that’s never a good sign. Therefore, knowing if a company is generating cash, and where it is coming from OR where it is going OUT is key.

WITCE (What is the Customer Experience) Cash Flow Statement Questions

- Is the customer cash flow positive or negative?

- How does what you sell affect cash flow?

- Does what you sell potentially improve cash flow; accounts receivables, inventories etc?

- How does the customers cash flow impact your deal strategy?

- Does it matter if you prospects or customers are cash flow positive or negative?

- Do you account for a companies cash flow health in your prospecting and sales process?

- Can you find opportunities to sell your product or service by reviewing a prospects or customers cash flow statement?

We’ve now covered the three most critical financial statements. The key is to look at them in tandem. By looking at them all at the same time can give you some real insight into who you are selling to, their financial health and most importantly potential data to improve your deal strategy or create new opportunities.

I hope you got something out of these three posts and found them informative. Not sure what’s up for next WITCE Wednesday, but I am liking this series so far, so I’m going to keep going for awhile.

If there is a topic you’d like me to cover, let me know.

0 Comments