Consumer Confidence and Sales: How Economic Factors Impact Prospects

In this weeks blog, I’m going to cover consumer confidence. I figured I would make this the first of a number of economic indicator posts. We are constantly bombarded by terms like this and their “believed” affect on the economy. I figure, why not flush them out a little more and in particular how they affect sales.

What is the Consumer Confidence Index?

Consumer confidence is an economic indicator measuring how the general populace feels about the economy and their own person financial situation. The concept goes like this, if people are optimistic or feel good about the economy and their personal situation, they will spend more and therefore keep the economy moving. If they are pessimistic, well the belief is, people will tighten their belts and economic growth will slow.

There are several consumer confidence tracking indicators, however the two most widely followed and used are the CCI or Consumer Confidence Index and the MCSI or The University of Michigan Consumer Sentiment Index.

The CCI surveys 5000 people each month and asks them 5 questions from these areas:

- current business conditions

- current business conditions for the next 6 months

- current employment conditions

- current employment conditions for the next 6 months

- total family income for the next 6 months

The Conference Board has been doing this on behalf of the United States since 1967.

The MCSI is based on a month telephone survey of U.S. households. It also asks 5 questions:

- personal financial situation now and a year ago

- personal financial situation on year from now

- overall financial condition of the business for the next twelve months

- overall financial condition of the business for the next five years

- current attitude toward buying major household items

There is also the Bloomberg Consumer Comfort Index and the Consumer Confidence Average, but I’m not going to go into those. You get the point.

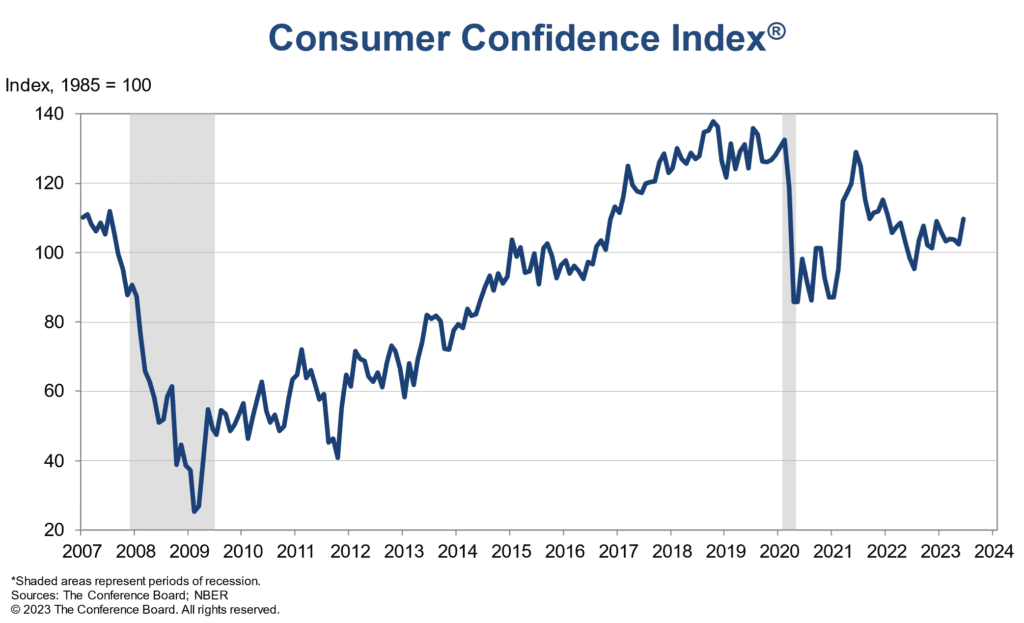

Here is a graph of consumer confidence over the past several years.

Notice how confidence drops just before a recession. Also notice how low it was during 2008 and 2009. Tough years. Although many call it a leading indicator, if you notice on this chart consumer confidence rarely leads a return to growth, but rather responds to it. In 1980, 1981, 1990, consumer confidence started falling after we entered a recession and didn’t start moving back up until after the recession was over. Not much of a leading indicator. That being said, banks, retail, manufacturers, government agencies, and investors use it for planning purposes and to forecast downturns or increases in consumer spending.

How does Consumer Confidence affect Sales?

Like all things connected, when companies see consumer confidence fall they then pull back themselves, retail reduces inventory, banks tighten lending, manufacturers slow production, home builders reduce construction starts. All this pull back reduces the spend of these companies and it’s almost always salespeople at the end of the rope. If you sell to builders, they are buying less from you. If you sell to retailers, they are tightening their belts. Quota just became a little more difficult. If you sell to banks, you better start getting creative. Companies buy from salespeople, when they stop spending it’s harder for you to make quota.

Consumer confidence isn’t going to make or break your business, but following it can lead to opportunities others aren’t looking for.

WITCE (What is the Customer’s Experience) Consumer Confidence Index Questions:

- Does consumer confidence affect your customers buying habits?

- Do you know how consumer confidence affects your ability to make quota?

- Do your customers follow the consumer confidence indexes and if so, how do they incorporate the indicators into their decision making?

- What happens to your customers business if their is a decline in consumer confidence?

- Are there trends within your customers or prospects business that are tied to consumer confidence?

- What would you do if your customer started to reduce their purchases and slow their buying because of the economy? Would you know what to do?

Consumer confidence provides good insight into how people feel about their financial well being and their ability to pay their bills, go on vacation, keep their job and stay afloat. How good it is at “indicating” where the economy is heading I couldn’t tell you. But knowing what your customers think and how they view consumer confidence, that’s probably a pretty good idea.

0 Comments