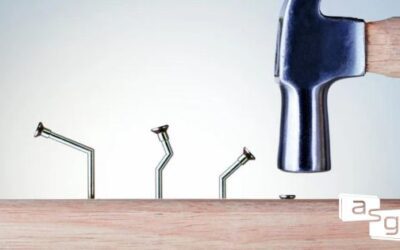

Now that we understand our ICP, Business Problems, and we understand that features are not going to win in a recession it’s time to place the final puzzle piece. We need to draw our attention to the most important piece of the sales funnel in order to succeed. Sales success in a recession hinges on how strong your CRM and approach to your funnel are. Rather than trying to fill the top of the funnel or getting things into the funnel we need to refocus our attention on the bottom.

Since the adoption of the BDR/SDR, we’ve been too interested in packing the top of the funnel, prospecting far and wide, and hoping something sticks. That’s not going to fly in a recession. You have potential business in the funnel. Focus on it!

You’re spending all this time and money to get new business into your funnel but how much are you spending on it once it’s in there. To improve your win rates, we need to take a good look at the qualitative data that is driving your buyers through the buying process. The first step in uncovering this information is to be sure you’re operating with a common sales methodology.

Without a common methodology you have no control over what information reps are collecting or not collecting. There is no cohesion in the sales process. A good methodology gets the entire team on the same page, your reps now know what information they should be collecting in order to maximize their influence on a sale. Not only that, you can now track how each piece of information affects the probability of a sale being closed.

The hardest part in this process is getting your sales team to move away from their individual styles and having them adopt this new methodology. But everyone needs to understand why this is important. Getting comparable data into the CRM is the easiest way for management to effectively evaluate the team’s weak points and which parts of discoveries are not working. Evaluating this data is a lot more difficult when you have several different selling styles floating around.

These evaluations are just as important as the entire team running from the same playbook. Implementing a common sales methodology is useless if there’s no evaluation or coaching happening.

The Right Information in the Right Places

The right information in the right places makes this process all come together. This means that your CRM is built to support your methodology. If you are a Gap Selling organization this means you have the Current and Future states defined with the physical and literal, problem, impact, emotion, root causes etc. If you decide to go with a MEDDIC methodology, then you need to have fields for metrics, economic buyer, decision criteria, etc. The right information should be easily accessible and easily evaluated against your methodology.

You should also be practicing Guided Selling. Guided Selling is the proactive and collaborative discussions between the sales rep and their manager at every stage of the buying process. There should be communication steps to ensure the methodology is being applied correctly and the necessary information is in the right spots. This is where you use tools like Noted Analytics. Managers are able to quickly and effectively score the probability of a deal closing.

Win rates improve when sales reps are capable of uncovering the current problem, the size of the problem, the impacts to the business goals, and the root causes of these problems.

Each piece that is missing increases the risk that the prospect will eventually walk. In order to be successful, we need to have a system in place that allows for coaching in these scenarios. Managers need to understand what data the rep has and has not collected and be able to correct where the system broke down.

In a recession, every deal is important. Again, organizations are running on tighter margins, time spent ineffectively on a deal that doesn’t close is money lost. Sales organizations have a tendency to focus on the biggest deals with the soonest close dates. This approach allows for too many opportunities to fall through the cracks.

Go look at your current deal reviews – how many are only looked at towards the end of the cycle? How many are reviewed at the beginning of the cycle? How many are reviewed more than once? You should be operating on a structured cadence, looking at each deal at 4 different steps along the process.

While you’re reviewing how many times your current deals have been touched, take a look at the information in that deal. Can you answer questions like: what is the BUSINESS problem they are experiencing? What is the impact of that problem on the business? What happens if they don’t solve the problem? Do they recognize that this problem, impact, and future if they don’t buy exists?

As mentioned earlier, the key is to measure and track the qualitative information, not just the quantitative information or the activities that have taken place. Build reports that highlight the deal’s opportunity score, average sales price, and time in the pipeline. Use your CRM effectively so that you can track a deal based on client information and problem identification and not just touchpoints and tasks.

Ready to find sales success in a recession? Download Keenan’s guide to selling in a recession here.

0 Comments